|

An imposed workplace scheme is not the only option for retirement, as more low-cost Sipps come on to the market.

The financial pages have been full of advice on pensions with the launch of auto-enrollment last week. It has thrown a desperately needed spotlight on how and why we should be saving for later life. But not everyone is happy that the state is stepping in. If you want to take control for your own retirement saving, a self-invested personal pension or Sipp, could prove a compelling alternative. Sipps are essentially do-it-yourself pensions, offer more flexibility and a wider range of investment choices than most personal pensions. As well as cash, government bonds and funds, you can choose to invest your money in more complicated investments such as individual shares, open-ended investment companies (Oeics), commercial property and commodities. They still benefit from all the features of a more traditional pension, including up to 50 per cent tax relief on pension contributions, but instead of trusting the provider to pick funds, you decide how to invest your contributions typically with a much wider range of funds to choose from and the opportunity to invest in direct equities by buying and selling shares. It's true that when they first emerged, Sipps were targeted at experienced investors with substantial pension pots, but as costs have come down they have proven to be an increasingly popular choice among the general population. "The Sipp market has been revolutionised in recent years with the emergence of low-cost plans, which have made them accessible to the mass market. Sipps are now becoming ISA-like in their appeal," says Jason Hollands of independent financial adviser (IFA) Bestinvest. Follow the link for further information on SIPPs - LINK To read the article in full follow the link - LINK Buccament Bay Resort wins “Caribbean’s Leading New Hotel” and “St Vincent & The Grenadines’ Leading Spa Resort” 2012

The WTA awards programme, hailed as “the Oscars of the travel industry” by the global media, highlights and rewards those travel brands that have made the greatest contribution to the industry over the past year. In winning “Caribbean’s Leading New Hotel” for 2012, Buccament Bay Resort beat the likes of Hotel Riu Palace Bavaro (Dominican Republic) and The Hotel Chocolat (St Lucia), whilst the St Vincent & The Grenadines “Leading Spa Resort” honour was awarded over competitors like Palm Island Resort, Petit St Vincent Resort and Young Island Resort. About the World Travel Awards WTA was launched in 1993 to acknowledge and recognise excellence in the global travel and tourism industry. Now celebrating its 19th anniversary, it is regarded as the very highest achievement that a travel product could hope to receive. A packed delegation of VIPs, senior tourism figures and international media traveled from more than 30 nations to attend WTA’s Caribbean & The Americas Ceremony 2012, which was supported by Turks & Caicos Tourist Board and Scotiabank. CARIBBEAN’S LEADING NEW HOTEL 2012 • Winner Buccament Bay Resort Other Nominees: • Cofresi Palm Beach & Spa Resort Dominican Republic • Hotel Riu Palace Bavaro Dominican Republic • The Hotel Chocolat St Lucia • The Magdalena Grand Beach Resort Tobago ST VINCENT & THE GRENADINES’ LEADING SPA RESORT 2012 • Winner Buccament Bay Resort Other Nominees: • Canouan Resort Grenadines • Palm Island Resort • Petit St. Vincent Resort • The Cotton House • Young Island Resort To find out more, please follow the link - BUCCAMENT BAY It is important when considering hotel investment that the hotel, operator and branding match the local area and market.

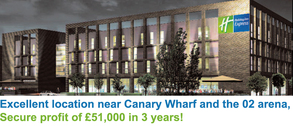

The Holiday Inn Express® London - ExCel, is located within London’s Royal Docks in East London – designated a “Special Enterprise Zone” in 2011. The site of the hotel will be under a mile from London’s City airport. The O2™ Arena can be reached in a few minutes and the hotel site is conveniently located for tourist attractions such as the National Maritime Museum, Greenwich Observatory and also Canary Wharf. Central London is only 25 minutes away THE EXCEL™ CENTRE about 2.5 minutes’ walk away. The hotel site is found on the waterfront in the centre of the Royal Docks. It was the UK’s first purpose built international convention centre boasting 100,000 sqm of exhibition space, opened in late 2000 and renovated and extended in 2010, which increased the capacity by 50%. It is used by blue-chip companies for meetings, AGM’s conventions as well as sporting and cultural events LONDON CITY AIRPORT (0.5 miles) is just 3 miles from London’s financial district and is vital for business and plays an important part in keeping up with the growth of London. The business community recognizes the convenience of its location and size. In 2009, London City airport gained permission to increase flights by 50% and in 2011, British Airways announced a number of new flights while Blue Islands Airline announced the launch of its new executive service from the airport. If you are looking for an arm chair hotel room investment in London this must be it. 50% non-status finance and prices from £135,000 on an RICS valuation of £161,000 combine this with the ideal location, exit strategy AND well-known operator. LINK - to further information. MILLIONS of new pensioners were warned this week that they face a retirement of poverty after weeks of slashed annual payouts.

Pension companies have cut rates offered on their guaranteed annuity incomes 24 times since the start of summer. Standard Life is the latest to do so, lopping five per cent off the rate offered to the newly-retired and those approaching retirement. And male pensioners will suffer an extra blow later this year with the introduction of the EU’s new “gender directive” which will further force down annuities for men. Craig Palfrey, founding partner of independent financial advisers Penguin Wealth, said: “Annuities are in meltdown. We’re way beyond red alert. They have been coming down relentlessly and Standard Life’s decision to take a sword to rates is just the latest example. Twenty years ago a £100,000 pension fund would have guaranteed an income of £15,640 a year for life for a 65-year-old man. Now it is just £5,140 a year. And the crisis decimating pensions is set to continue for months, perhaps even years, piling on the agony for the newly-retired. Experts warn that the situation is likely to worsen as annuity providers struggle with volatility in the stock market and the Bank of England’s quantitative easing (QE) strategy to tackle the recession. The money-printing policy has been attacked for triggering “a death spiral” in pensions, which some experts say has led to the worst retirement payouts in history. NOW is the time to take control of YOUR pension before it is too late - SIPP LINK. Chat show host invests in the 5* Buccament Bay resort on Saint Vincent in the Caribbean.

Link to the information page - HOTEL RESORT SALES A LIFESTYLE INVESTMENT FROM ONLY €50,000

PURCHASE A LUXURY HOTEL ROOM OR SUITE IN BELLE PLAGNE IN THE FRENCH ALPS ROOM PRICES FROM €50,000 Euros – (NOT FRACTIONAL OR TIMESHARE). SELLING PRICES SHOW A 10% SAVING ON CURRENT MARKET VALUE. ALL MORTGAGE CHARGES AND MANAGEMENT FEES PAID FROM RENTAL INCOME!! EXIT STRATEGY AFTER 5 YEARS OF 296% or €147,946. THIS IS A FULLY MANAGED BY ONE OF THE UK’S LEADING TOUR OPERATORS AND IS A NEW BUILD DEVELOPMENT PROVIDING WINTER SKIING AND SUMMER HOLIDAYS. ADDITIONAL BONUS OF 7 DAYS FREE IN WINTER AND 7 DAYS FREE IN SUMMER (NOT INCLUDED IF PURCHASED VIA A SIPP) Link to further information - 4* SKI HOTEL ROOMS Millions will see pensions slashed by up to 20% as new EU rules are set to send annuities plummeting22/6/2012

MORE bad news on pension's!! TIME TO ACT!

Millions of people could see the value of their pensions slashed by up to 20 per cent because of new EU rules. Those with a £100,000 pension fund could be more than £1,100 per year worse off in retirement because of the reforms, research has shown. The Solvency II rules, which are due to come into effect in January 2014, will force pension funds to hold a higher proportion of 'safe' Government bonds. As the bonds - called gilts - have such low rates of return it will drive down the returns on retirement fund annuities, which are used to pension income. The reforms are designed to make pension funds safer and reduce the risk of them going bust. Annuities, which set retirement income for life, have already fallen to historic lows because of the impact of quantitative easing. At present, a pension annuity fund may invest 20 per cent in low-yield gilts and the rest in riskier corporate bonds which have a higher rate of return. But under the new EU rules, annuity funds will be forced to hold a higher percentage of gilts. New research by Deloitte suggests annuity rates will plunge by between five and 20 per cent when the directive comes into force in January 2014. A £100,000 pension pot currently gives an income of £5,837, but once the regulations come into effect they will be between £292 and £1,167 a year worse off. Take control of your pension by investing in Alternative Investments via a SIPP. LINK TO SIPP INFORMATION PAGE AND VIDEO - SIPP's LINK Read more: ARTICLE LINK Hundreds of thousands of pension investors are earning little or no interest on cash held in their schemes – prompting advisers to suggest they seek better returns elsewhere.

Research has revealed that some of the country’s largest providers of self-invested personal pensions (Sipps) and small self-administered schemes (SSAS) are paying well below the Bank of England (BoE) base rate on cash deposits. Some providers have even lowered their rates while BoE rate has remained steady at 0.5 per cent for more than two years. Aegon, one of the leading Sipp providers, is not paying any interest on its instant-access Sipp bank account, and has not done so since 2009. James Hay’s Sipp account – which is offered to investors in its iSipp and JH Sipp & Wrap pensions and operated by Santander – is currently paying just 0.00001 per cent interest. Hornbuckle Mitchell pays between 0.1 and 0.15 per cent depending how much cash is deposited. If you have money earning little or no return take a look at the insured loan note opportunity paying 10% over 12 months or 24% over 2 years and can be invest in via a SIPP - LINK |

AuthorInvestment Property Worldwide will try bring to you a diverse range of property, investment news. Archives

October 2014

Categories

All

|

| Investment Property Worldwide.com |

|

RSS Feed

RSS Feed