|

An imposed workplace scheme is not the only option for retirement, as more low-cost Sipps come on to the market.

The financial pages have been full of advice on pensions with the launch of auto-enrollment last week. It has thrown a desperately needed spotlight on how and why we should be saving for later life. But not everyone is happy that the state is stepping in. If you want to take control for your own retirement saving, a self-invested personal pension or Sipp, could prove a compelling alternative. Sipps are essentially do-it-yourself pensions, offer more flexibility and a wider range of investment choices than most personal pensions. As well as cash, government bonds and funds, you can choose to invest your money in more complicated investments such as individual shares, open-ended investment companies (Oeics), commercial property and commodities. They still benefit from all the features of a more traditional pension, including up to 50 per cent tax relief on pension contributions, but instead of trusting the provider to pick funds, you decide how to invest your contributions typically with a much wider range of funds to choose from and the opportunity to invest in direct equities by buying and selling shares. It's true that when they first emerged, Sipps were targeted at experienced investors with substantial pension pots, but as costs have come down they have proven to be an increasingly popular choice among the general population. "The Sipp market has been revolutionised in recent years with the emergence of low-cost plans, which have made them accessible to the mass market. Sipps are now becoming ISA-like in their appeal," says Jason Hollands of independent financial adviser (IFA) Bestinvest. Follow the link for further information on SIPPs - LINK To read the article in full follow the link - LINK A substantial fall in the number of people going bankrupt could be due to high fees not any improvement in personal finances, a leading debt advice body has warned.

Joanna Elson, the chief executive of the Money Advice Trust, said that a 10 per cent fall in the numbers of people going insolvent "may largely be driven by increases in the fees required to make yourself bankrupt". She added: "People struggling with debt often can't afford the £700 it costs to go bankrupt [£525 for the deposit plus £175 for the court fee], even though it would otherwise be their best option. "This leaves them in a financial black hole. The numbers using debt relief orders, one of the cheaper remedies, has risen." On Friday, it was revealed there were 27,390 personal insolvencies in England and Wales in the second quarter of this year, a 10 per cent decrease on the same period a year ago and the lowest figure since the summer of 2008. The figures are a surprise as the UK has recently entered recession, but Ms Elson warned insolvencies may spike again later this year: "These figures are likely to get worse, with incomes increasingly unable to match rising prices." It is important when considering hotel investment that the hotel, operator and branding match the local area and market.

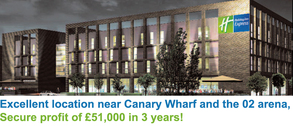

The Holiday Inn Express® London - ExCel, is located within London’s Royal Docks in East London – designated a “Special Enterprise Zone” in 2011. The site of the hotel will be under a mile from London’s City airport. The O2™ Arena can be reached in a few minutes and the hotel site is conveniently located for tourist attractions such as the National Maritime Museum, Greenwich Observatory and also Canary Wharf. Central London is only 25 minutes away THE EXCEL™ CENTRE about 2.5 minutes’ walk away. The hotel site is found on the waterfront in the centre of the Royal Docks. It was the UK’s first purpose built international convention centre boasting 100,000 sqm of exhibition space, opened in late 2000 and renovated and extended in 2010, which increased the capacity by 50%. It is used by blue-chip companies for meetings, AGM’s conventions as well as sporting and cultural events LONDON CITY AIRPORT (0.5 miles) is just 3 miles from London’s financial district and is vital for business and plays an important part in keeping up with the growth of London. The business community recognizes the convenience of its location and size. In 2009, London City airport gained permission to increase flights by 50% and in 2011, British Airways announced a number of new flights while Blue Islands Airline announced the launch of its new executive service from the airport. If you are looking for an arm chair hotel room investment in London this must be it. 50% non-status finance and prices from £135,000 on an RICS valuation of £161,000 combine this with the ideal location, exit strategy AND well-known operator. LINK - to further information. Families' budgets are squeezed by increased utility costs, soaring food prices and salary freezes.

Five million households currently face increases in their fuel bills of up to £100-a-year as SSE, the UK’s second biggest energy company after British Gas, said that from mid-October the price of an average annual dual fuel bill will rise from £1,172 to £1,274. Other companies are expected to follow suit. As well as energy bills rising, mortgage payments are set to increase as other lenders follow Santander’s suit in upping its Standard Variable Rate (SVR). Many individual salaries are being frozen and one in ten employees is being forced to take a pay cut. With the combination of increased utility costs, soaring food prices and a compounding squeeze on salaries, Moneysupermarket.com has found that 80pc of households are on a financial budget irrespective of income, demographic or family set up. In order to ease the financial burden many Brits making extensive cut backs where they can. Almost half of us have had to use credit in order to pay utility bills, while a 25pc of adults have said that they are forced to rely more on credit cards to ensure that the regular household outgoings are covered. Clare Francis financial expert at Moneysupermarket.com comments: "The fact a rise in outgoings of £50 or less would tip a third of Brits to ‘financial breaking point’ speaks volumes about how difficult people are finding things at the moment." Article published in the Telegraph follow the link to read the article - http://bit.ly/OXKL1M If you’re planning to transfer currency for an overseas investment, you’ll probably

talk to your high-street bank. Don’t! You’ll save money by going to a specialist currency exchange dealer. Send all your international transfers through currency dealers rather than banks. Why? They give you a better exchange rate, lower costs and a speedier service. This is a constant source of annoyance to the banks but they can't compete with dealers. An average high-street bank will probably offer spot rate (the real, interbank, rate of exchange), less 4 per cent. An average currency dealer will offer an ordinary customer spot rate, less 2 per cent. On a £100,000 transfer you save £2,000 on the exchange rate alone. The dealers will be quicker too. In the days before currency dealers became popular, the money would be send by a UK bank to another country via another bank in the local country who would then eventually send it to the end bank. There were three banks involved but, more crucially, there would be a bank in the middle that didn't really care how long it took them to send the money! Check the Charges When it comes to comparing dealers, it is worth remembering that, in addition to exchange rate differences, there are also differences in charges. Currency dealers typically charge less than high-street banks for transferring money abroad. In fact, many of them don't charge anything at all or, more accurately, they incorporate the fees into the exchange rate. One example of this is - two transfers to Turkey done through a well-known high-street bank. The first for £100,000 and the second was for £200,000. The high street bank charged fees of £535 and £1035 respectively. This is a total of £1,570 just in bank charges. A currency dealer would have charged either nothing or a nominal amount such as £20 (i.e. a saving of £1,550). And remember that this is in addition to the exchange rate differences (which probably amount to another couple of thousand pounds). Link to our currency exchange partner page - LINK The Con-Trick

Here’s how it works. When you’re on the beach, you’ll be offered scratch cards. They’re a euro or two, that’s all. But you could win a big prize. And guess what, you’ve gone and won a big one! All you’ve got to do is go along to a free holiday presentation to collect it. Holidaymakers do. Heck, why not? It’s only a morning and it’s a real big prize! The presentation’s slick and impressive and you’re offered the chance to join an exclusive holiday club offering exciting, value-for-money holidays all over the world. Only the very best accommodation and at really low prices – after all, you’re in the club. And people sign up! Problem is you could get the same holidays at the same prices online and even at your local travel agency. Even worse, by the time you get home, that holiday club has disappeared. The OFT’s Advice The OFT warns consumers about what happens. They’re saying that 400,000 UK consumers fall victim to these clubs at a cost of over £1 billion each and every year. 400,000! That’s a city the size of Bristol. This is a big scam and lots of ordinary people are being conned. The con-artists say that the special discounted offer is only valid for that day, encouraging people to sign up or miss out. These scam-artists just won’t let you go. You’re never left alone to discuss anything with your partner. And you are given a very limited time to view the contract! The Bottom Line The OFT says that if you go along to a presentation you should ask three simple questions. Do you give cooling off rights? Is everything you promised in the presentation in the contract? Can I take away the contract to consider at my leisure? If the answer to any of these questions is no, walk away. That’s sometimes easier said than done. Some presentations last so long that some people sign up just to get away. The best advice is simple – don’t even buy the scratch card in the first place! Have a great holiday. Get a tan. Have a nice swim. Go and see the sights. And don’t get conned by this scam. For the best holiday money rates follow the link - CURRENCY There are many reasons why you may have been the victim of payment protection insurance (PPI) mis-selling. If you have been mis-sold PPI you could be entitled to claim compensation. To help you find out if you are a victim I have produced a quick checklist so you can see if you may have a claim.

First, you need to check if you had PPI on any credit cards or personal loans during the past six years, even if you have since paid them off. If you did have PPI then run through the checklist below your bank or lender had a responsibility to ensure the PPI was suitable for you at the time it was sold to you. · Did your bank or lender tell you that you must have the PPI as part of the deal to get the credit card or loan? If so, that’s wrong. Having PPI is entirely optional. · Was the PPI added to your credit card or personal loan without your knowledge? For most people it is not immediately apparent they are paying for PPI because its cost is merged into the loan repayments. The terms and cost of the insurance should have been explained and checked for suitability. · Were you unemployed, self-employed, redundant, a student or retired? If so and you were sold employment cover as part of the PPI policy then it’s often worthless. You should have been made aware of this. · Did you have any pre-existing medical conditions? Your bank or lender should have checked this as any pre-existing medical conditions are likely to be excluded from the PPI cover. You should have been made aware of this. · Did you already have existing cover through benefits available from your employer? If so, your bank or lender should have checked this. If one or more of these points apply to your circumstances at the time the PPI policy was sold to you, then it’s likely you are the victim of mis-selling. Millions will see pensions slashed by up to 20% as new EU rules are set to send annuities plummeting22/6/2012

MORE bad news on pension's!! TIME TO ACT!

Millions of people could see the value of their pensions slashed by up to 20 per cent because of new EU rules. Those with a £100,000 pension fund could be more than £1,100 per year worse off in retirement because of the reforms, research has shown. The Solvency II rules, which are due to come into effect in January 2014, will force pension funds to hold a higher proportion of 'safe' Government bonds. As the bonds - called gilts - have such low rates of return it will drive down the returns on retirement fund annuities, which are used to pension income. The reforms are designed to make pension funds safer and reduce the risk of them going bust. Annuities, which set retirement income for life, have already fallen to historic lows because of the impact of quantitative easing. At present, a pension annuity fund may invest 20 per cent in low-yield gilts and the rest in riskier corporate bonds which have a higher rate of return. But under the new EU rules, annuity funds will be forced to hold a higher percentage of gilts. New research by Deloitte suggests annuity rates will plunge by between five and 20 per cent when the directive comes into force in January 2014. A £100,000 pension pot currently gives an income of £5,837, but once the regulations come into effect they will be between £292 and £1,167 a year worse off. Take control of your pension by investing in Alternative Investments via a SIPP. LINK TO SIPP INFORMATION PAGE AND VIDEO - SIPP's LINK Read more: ARTICLE LINK Governor King’s Inflation Report press conference will provide a timely update on how the Bank of England is viewing current financial market developments. The Inflation Report itself will contain medium-term forecasts for the economy. Lloyds TSB have argued that the Bank’s growth forecasts appear too optimistic and its central case is likely to be revised down from just under 2% this year and 2½% next. This is particularly true with the apparent materialisation of downside risks from the Eurozone. Lloyds TSB would also expect to see an associated softening in next year’s inflation outlook (although for 2011 should remain broadly unchanged) despite a boost from lower market rates that the Bank uses to condition these projections. Yet these forecasts still look likely to suggest a set of economic conditions very different from those that led the Bank to ease monetary policy to its historic lows. Nevertheless, with global financial markets threatening to reverse developed economies recoveries, the MPC’s discussions will be dominated by assessments of how much damage the current financial turmoil will wreak on the real economy. This week’s trade release will gauge the ongoing pace of rebalancing in the economy. May saw the deficit widen with trade (including services) breaching the £4.0bn mark for the first time this year. Much of this reflected a jump in imports that Lloyds TSB expect to reverse in June. Accordingly Lloyds TSB forecast the deficit narrowing to £3.8bn. However, Q2 looks unlikely to provide further evidence of an export led recovery. Export volumes look likely to have fallen in Q2 and net trade should have detracted from growth. As with the wider economy, one-off factors affected Q2. But with global economic activity seemingly slowing, export prospects have weakened.

The final release of the quarter is always somewhat historical, with preliminary estimates inferred from the GDP release. Official estimates for manufacturing that recorded a 0.3% contraction in Q2, consistent with a 0.2% rise in June. However, Lloyds TSB suspect that oil production staged a bigger rebound in June than assumed, something that would lead to a 0.6% rise in the wider industrial measure and result in a 1.3% quarterly decline (1.4% estimated). This will have little impact on Q2 GDP, but would provide some support for the expected rebound in oil in Q3. Given market developments, focus has now shifted to the likely pace of Q3 expansion. Written by Ashley Ingle - Excel Currencies August 8, 2011 at 10:57 AM |

AuthorInvestment Property Worldwide will try bring to you a diverse range of property, investment news. Archives

October 2014

Categories

All

|

| Investment Property Worldwide.com |

|

RSS Feed

RSS Feed